FBI: New & Evolving Internet Crimes Cause Record Financial Loss

Phishing, vishing, smishing and pharming may sound like a foreign language or the latest dance moves, but according to the Federal Bureau of Investigation’s (FBI) 2021 Internet Crime Report, they are the leading crimes of the internet. These are words you need to become familiar with because anyone using a computer or smartphone could join nearly 324,000 victims who lost over $44 million to these crimes last year. Business Email Compromise (BEC) and Email Account Compromise (EAC) – two ways that phishing can transpire – cost businesses and consumers $2.4 billion in 2021.

This blog explores these crimes in more detail to help you avoid becoming another statistic – especially if you’re involved in a real estate transaction.

Why Are These Crimes on the Rise?

The reason is simple. More people than ever are online and deception is much harder to spot than it used to be. (Remember those cryptic requests to send money to Nigeria? That one is still around but most cybercriminals have stepped up their game). These days, they are more likely to contact you pretending to be someone you actually know, like a family member, friend, coworker, or someone you’re doing business with. Cybercriminals can find your contacts by hacking into unsecure email accounts, searching the internet or public records, and browsing your social media accounts.

Savvy cybercriminals changed their approach during the COVID-19 pandemic. They take advantage of remote work environments and supply chain issues to execute virtual meeting scams, exploit job recruitment websites, commit invoicing fraud and more.

Terms & Tactics

According to the FBI, each crime below targets a different form of communication, but all are designed to trick you into giving cybercriminals information they shouldn’t have access to. That includes personal and financial information and login credentials they can use to steal your data or funds.

- Phishing – These scams target email, often using spoofing techniques (slight variations on legitimate email addresses) to fool victims into thinking fake accounts are authentic.

BEC, which targets business emails, and EAC, which targets personal emails, are phishing scams designed to dupe the email recipient into performing the unauthorized transfer of funds.

- Vishing – These scams happen over the phone, voice email, or VoIP (voice over Internet Protocol). Bad actors call claiming to represent a legitimate business but provide a fake phone number or website so they can intercept your funds.

- Smishing – These scams target SMS (text) messages, often by enticing recipients to click on a link. Doing so can download malicious code onto your phone, which could damage or disable it.

- Pharming – Not to be confused with real estate farming, these scams occur when malicious code is installed on your computer to redirect you to fake websites. Cybercriminals hope you don’t notice, so they can steal your account number or password when you attempt to log on.

2021 Crime Recap

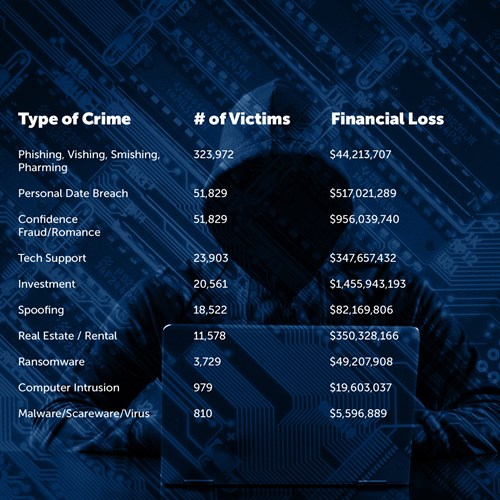

The FBI formed the Internet Crime Complaint Center (IC3) in May 2000 to investigate and report on new and growing crimes. Here’s a breakdown of their 2021 Internet Crime Report.

Key Findings

- Americans filed 847,376 complaints of internet crime – the highest on record.

- Financial loss from all forms of internet crime exceeded $6.9 billion – up 64 percent from 2020.

- Phishing, vishing, smishing and pharming increased 34 percent from 2020.

- BEC and EAC caused the most financial loss (35 percent) of any internet crime.

- Total financial loss due to BEC and EAC was $2.4 billion – up 28 percent from 2020.

- The average loss per email fraud incident was $120,074 – up nearly 25 percent from 2020.

Real Estate Transactions

It’s worth noting that IC3 created a category just for real estate crimes because the fraud and loss associated with these transactions is so high. Real estate deals are appealing to many cybercriminals because of the large payout. They also know that closing on a home can be a stressful time for consumers, who may not question any last-minute changes to wiring instructions that appear to come from someone handling their transaction.

Whether you are a real estate professional, a title agent, or a consumer, it is vital to remain vigilant throughout the entire transaction. Closing agents should communicate clearly and upfront to all parties about how the closing and funding processes will occur. It is important to note that wire instructions rarely change. Buyers and sellers should always use established telephone numbers – NEVER ones that appear in unsolicited messages – to verify any unexpected change or request before acting on them.